Multi-level Optimisation for Multi-scale Energy Markets

Multi-level Optimisation for Multi-scale Energy Markets

Background and Challenges

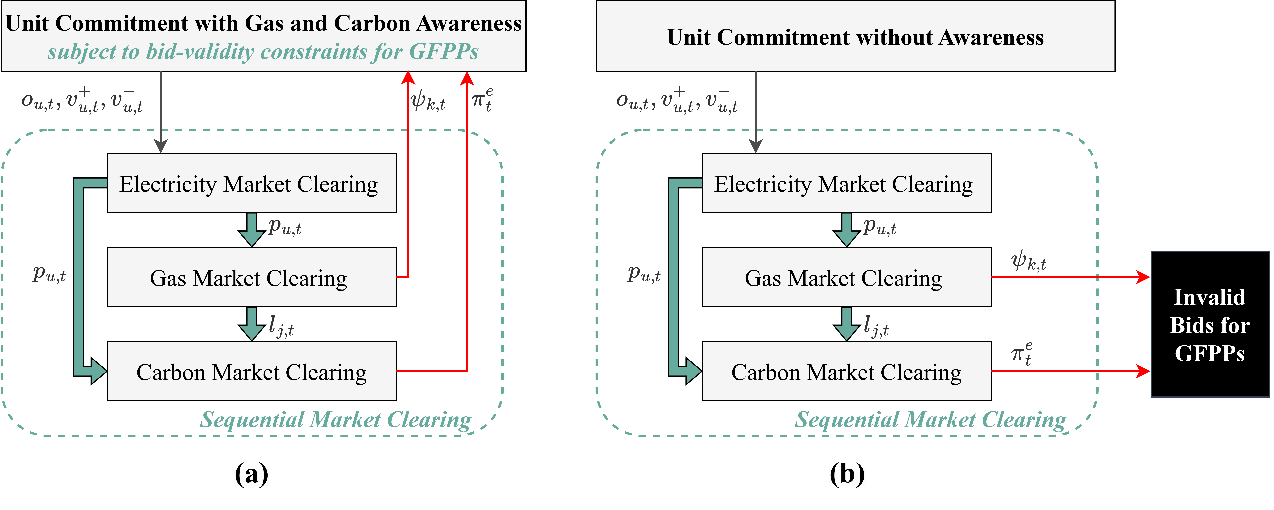

Energy markets operate across multiple dimensions, including temporal, spatial, operational, and hierarchical aspects. Key decisions, such as unit commitment, are made in advance, often without full knowledge of future market conditions. This lack of foresight and awareness can lead to suboptimal decisions. For example, when gas or carbon prices increase significantly, previously committed gas-fired power plants (GFPPs) may become unprofitable, resulting in substantial financial losses.

Our research addresses these challenges by developing a Mixed-Integer Multi-Level problem with Sequential Followers (MIMLSF) framework. This approach explicitly models sequential market-clearing processes and enables upper-level strategic decisions—such as investment, unit commitment, and strategic bidding—to account for sequential market responses.

To efficiently solve the MIMLSF, we developed:

1. A single-level approximation using lexicographic optimization and the weighted-sum method.

2. A dedicated Benders decomposition for computational scalability.

Applications

This framework enables the modeling of:

1. Four-Level Gas and Carbon-Aware Unit Commitment: Enhances unit commitment decisions by accounting for future gas and carbon prices and decommitting unprofitable GFPPs, reducing financial risks.

2. Tri-Level Transmission Investment Planning: Integrates local energy market operations into transmission investment decisions, enabling transmission companies to account for local flexibility and its impact on grid expansion.

3. Tri-Level Optimization for DER Revenue Stacking: Enables flexibility service providers to manage the participation of DERs in day-ahead, reserve, local energy, and flexibility markets across both national and local levels, maximizing revenue potential.

Principal Investigator

Doctoral Students

Yuxin Xia

DPhil Student

Recent Publications

-

Y. Xia, I. Savelli, and T. Morstyn, “Scalable Multi-Level Optimization for Sequentially Cleared Energy Markets with a Case Study on Gas and Carbon Aware Unit Commitment,” arXiv preprint arXiv:2502.13643, 2025. [Online]. Available: https://arxiv.org/abs/2502.13643.

-

Y. Xia, I. Savelli and T. Morstyn, “Integrating local market operations into transmission investment: A tri-level optimization approach,” Applied Energy, vol. 378, p. 124721, 2025.

-

A. Paredes, J. A. Aguado, C. Essayeh, Y. Xia, I. Savelli and T. Morstyn, “Stacking Revenues From Flexible DERs in Multi-Scale Markets Using Tri-Level Optimization,” in IEEE Transactions on Power Systems, vol. 39, no. 2, pp. 3949-3961, March 2024, doi: 10.1109/TPWRS.2023.3286178